Money talks: markets stepping up local AB&C law enforcement

Our research suggests that governments are attempting to improve their bribery and corruption reputations to make business conditions more favorable for multinationals.

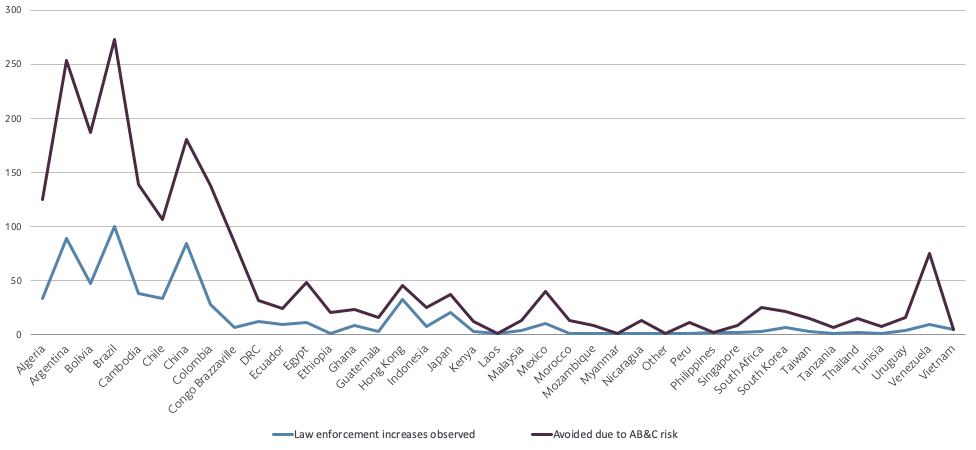

There is a strong correlation between the markets that have not been entered due to high bribery and corruption risk, and those where respondents have seen the biggest increase in local enforcement in the last 10 years. This perhaps indicates that governments have had to sit up and take notice of large organizations’ expansion plans and clean up their local law enforcement to encourage entry to their market and improve their reputation globally.

When it comes to entering new markets, there are two distinct AB&C risks that organizations need to bear in mind. One is local AB&C enforcement, and the second is the risk of extraterritorial enforcement of their own country’s regulation. It’s likely that the latter is causing companies more concern: if a particular market is known for high levels of bribery and corruption risk, UK or U.S. regulators may be more likely to scrutinize activity there.

Figure 9: The correlation between the markets that companies have avoided due to high bribery and corruption risk, and the markets where respondents have seen the biggest increase in enforcement over the last 10 years.

Conducting business in emerging markets: bribery and corruption risk

Compliance leaders believe that bribery and corruption in one country often suggests region-wide problems. Over 60% said that if they found bribery and corruption issues in one jurisdiction, it was likely to be an issue across the whole region, impacting their organization’s decision to conduct business in that part of the world.

It is government corruption that’s causing the most concern, cited as one of the main AB&C reasons for avoiding a market by 82% of compliance leaders. This is particularly concerning given that so many companies rely on government contracts to conduct business in these regions. Almost half of companies rely on government contracts in Latin America (49%) and Africa (45%), while 58% of companies rely on government contracts to do business in Asia.

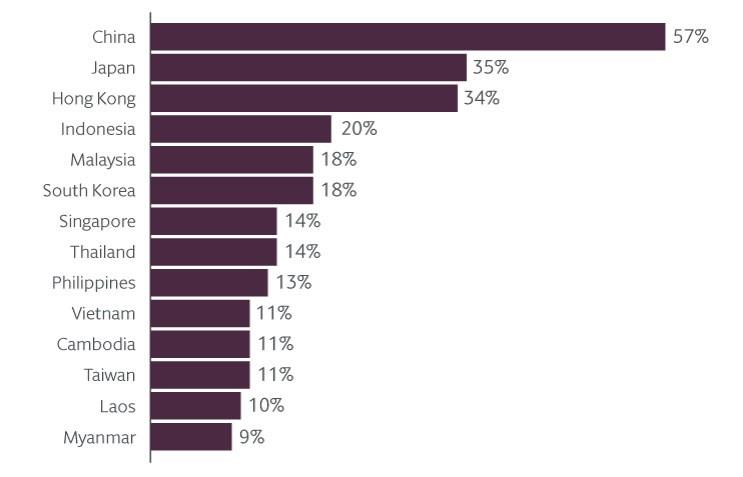

Asia

Asian markets are hugely diverse in terms of their legal and regulatory processes, their stage of economic development, and their levels of bribery and corruption risk. For example, financial hub Singapore is often ranked one of the world’s least corrupt jurisdictions,7 while Indonesia has struggled with corruption but has recently seen some improvements, and Vietnam has been involved in several corruption scandals and seen its Corruption Perceptions Index score decline.8

This complex landscape may help to explain why so many U.S. and European compliance leaders have concerns about bribery and corruption in Asia. The reality is, in some markets in South-East Asia, corruption is still an everyday occurrence, and it can be very challenging for U.S. and European corporations to get a handle on the risk and manage it effectively.

Figure 10: The markets in Asia that raise the most bribery and corruption concerns when it comes to doing business

The Asian market most likely to cause concern is China. The sheer magnitude of China’s economy and the range of industries that operate in the country may go some way to explaining this finding. There are also cultural factors to consider, including the guanxi culture of relationship building through gift giving.

China has, however, seen growing regulatory and enforcement action in recent years. Across all the markets in our study, Chinese compliance leaders are the most likely to say that regulatory pressure is increasing (80%, compared to an average of 68%). The Chinese government launched a high-profile campaign against corruption in 2012, which has resulted in thousands of investigations, and a new anti-corruption body called the National Supervision Committee was created in 2018.

When an organization is trying to assess risk in different jurisdictions, it makes sense to group together markets that have similar legal systems, cultural backgrounds, and ways of doing business. However, care is needed when actually implementing policies: problems in one market are not necessarily regionwide. Some neighboring markets have very different legal and regulatory systems and are at a different stage in their economic life cycle, despite geographic or cultural proximity. This is particularly the case in Asia; the vastness of China’s economy and the diverse range of industries in which it operates make it very different from its neighbors.

When assessing risk, companies need to think about the markets where they already operate and consider whether there are substantial similarities in terms of the type of business they will be doing, and the market’s legal and regulatory framework and risk profile.

Phoebe Yan,

Counsel, Shanghai FTZ, Hogan Lovells Fidelity

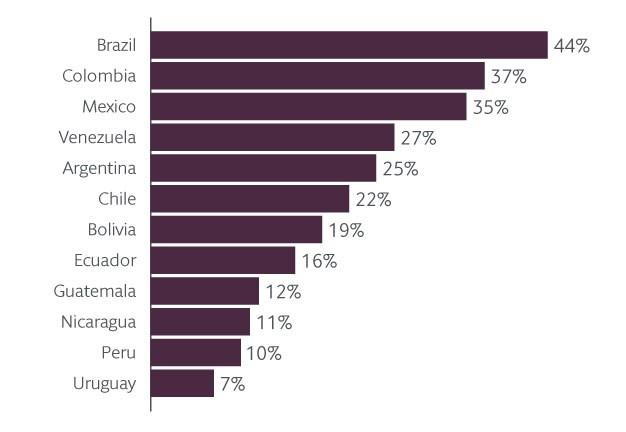

Latin America

Our study finds that Latin American nations are the most likely to be avoided entirely due to high bribery and corruption risk. Brazil, Argentina, Bolivia, and Belize are the markets that companies are most likely to have chosen not to enter due to AB&C concerns.

Massive corruption scandals and socio-political instability in several Latin American nations have led to a perception that these markets are high risk. But there’s also a growing sense that younger generations want to change the culture, with an increase in whistleblowing, and mounting demands for politicians and corporations to be held to account for unethical behavior.

Several jurisdictions, including Brazil, Mexico, and Argentina, have passed new anti-corruption legislation in recent years, including tough criminal liability and steep penalties. Presidents have come to power promising corruption crackdowns, such as Andrés Manuel López Obrador in Mexico. In Brazil, former president Michel Temer has been arrested as part of corruption investigations.

Figure 11: The markets in Latin America that raise the most bribery and corruption concerns when it comes to doing business

Our study finds that the Latin American market most likely to cause concern is Brazil. Although the country’s economy is currently struggling, previous high levels of growth have attracted a lot of attention from international corporates. Balancing investment in Brazil with the potential risks can be a challenge. Many employees – especially younger generations – see it as their duty to root out corruption, and the uptake of whistleblowing hotlines has been particularly high. The heavily-publicized “Car Wash” scandal has put the spotlight on corruption in Brazil, and corruption investigations or prosecutions feature in the news regularly. Attitudes seem to be changing as a result, with company leaders and employees much more open to compliance training and more willing to engage in the fight against bribery and corruption.

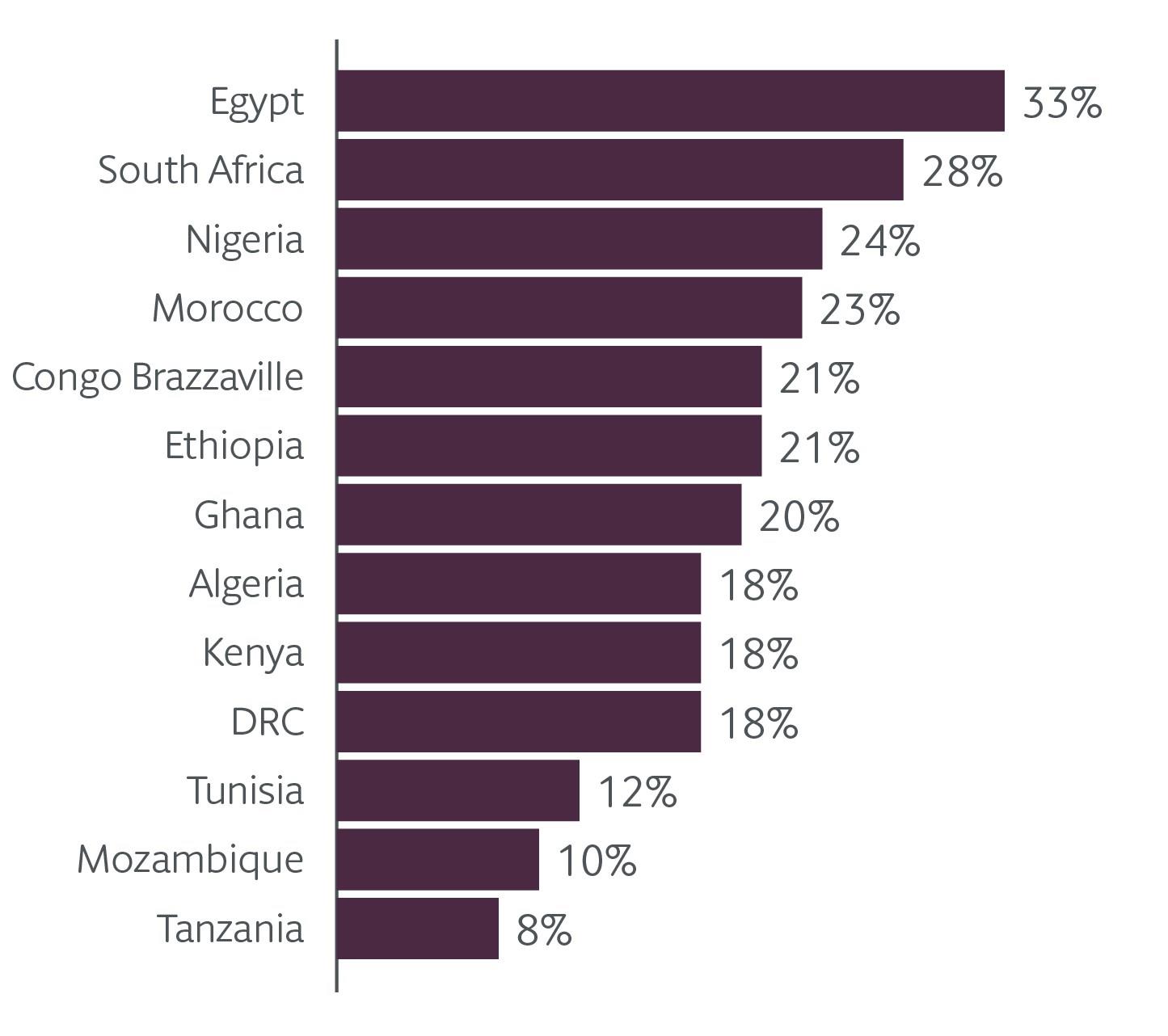

Africa

Figure 12: The markets in Africa that raise the most bribery and corruption concerns when it comes to doing business

The three African markets that raise the most bribery and corruption concerns are the three biggest economies on the continent, measured by GDP: Nigeria, South Africa and Egypt. South Africa has strong financial and legal systems and has seen a rise in powerful investigative journalism that is shedding light on corruption issues, but enforcement is weak. The country has had a well-publicized struggle with ‘state capture’ – state bodies such as the police, the prosecution authority, and the tax authorities misappropriating public funds – and former president Jacob Zuma is currently awaiting trial for corruption. But although a commission of inquiry into state capture is underway, the state’s resources to prosecute are limited, and so far there has not been a single successful prosecution.

Although not all African countries have the same level of journalistic freedom as South Africa, the continent is rapidly embracing new digital technologies. Social media and the rise of “citizen journalism” mean that bribery and corruption breaches are more likely to come to light. But exposing corruption is one thing, and successful enforcement is quite another. States need strong, independent judiciaries and adequate resources to combat corruption. Without this, successful prosecutions are unlikely, and African countries will continue to pose bribery and corruption compliance challenges to multinationals.

Wessel Badenhorst

Partner, Johannesburg

Approaches to implementation

It’s clear that companies are concerned about the compliance risks that markets in Asia, Africa, and Latin America pose, but how are they mitigating these risks? Organizations must find ways of delivering their guidelines and complying with international regulations, ensuring that they are followed by everyone who works for the company.

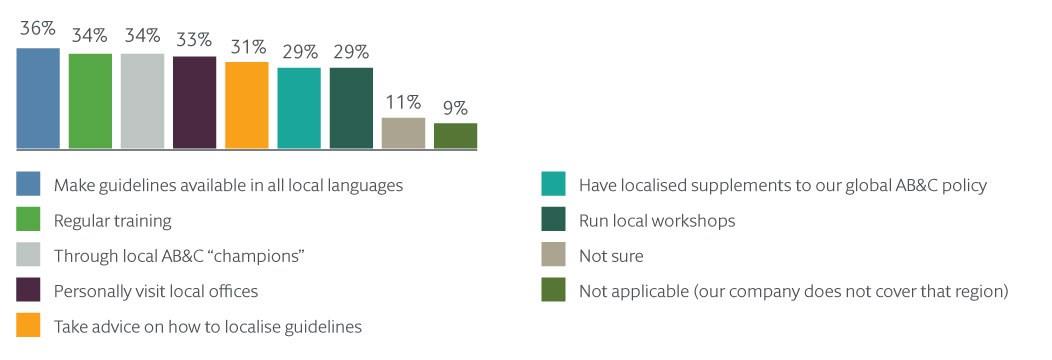

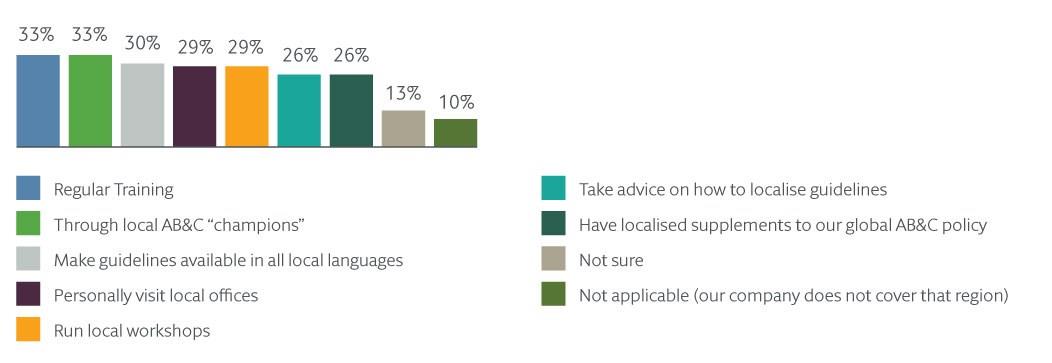

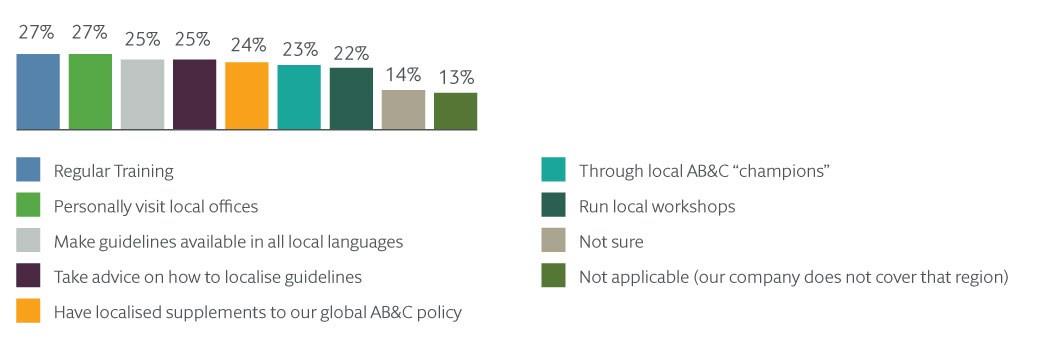

When we asked how compliance leaders implemented AB&C procedures, regular training and producing guidelines in local languages were the most common approaches. Meanwhile, fewer than a third of organizations have localized supplements to their global AB&C policy for Asia (29%) and Latin America (28%), and fewer than a quarter have localized their policies for Africa (24%).

There are also some interesting shifts in approach that have taken place over the last few years. While over half (57%) of businesses made guidelines available in local languages in 2016, only 30% currently take this approach, perhaps suggesting that companies increasingly expect local operations to be conducted in English.

Figure 13: Organizations’ approaches to implementing AB&C procedures across Asia, Latin America, and Africa

Figure 13a. How companies implement AB&C policies across Asia

Figure 13b. How companies implement AB&C policies across Latin America

Figure 13c. How companies implement AB&C policies across Africa

It’s worth noting, however, that although regular training is one of the most common approaches, it’s still only cited as an implementation approach by around a third of compliance leaders. While organizations recognize the risks inherent in these markets and the challenge of balancing the desire for growth with a careful approach to compliance, the majority are not putting measures in place to manage this risk.

Obliging third parties to comply with company-level policies can be challenging, but from a government or regulator’s point of view, this is not an excuse for non-compliance. Companies must have a uniform policy across their business, which is reviewed regularly. They need to have proper systems in place to ensure that wherever in the world they are operating, they remain compliant, and that anyone who works on behalf of their company is fully apprised of the policy and properly trained.

When it comes to instruction and supervision of employees, sending around a policy or posting it on an intranet is not enough: comprehensive training, in most cases face-to-face, is key and expected by regulators.

Désirée Maier

Partner, Munich