Why continued investment in AB&C matters

Against a backdrop of slow global growth, business leaders are struggling to balance the quest for corporate expansion with increased compliance pressure. More than two-thirds (68%) of compliance leaders believe that regulatory pressure is increasing, and over half (52%) say that although AB&C demands are ever-growing, their organization is cutting overall budgets.

Compliance leaders are right to believe that regulatory pressure is increasing. Enforcement is becoming more joined up, as multilateral bodies like the UN, the IMF, and the World Bank, and national agencies like the U.S. Department of Justice (DoJ) and the UK’s Serious Fraud Office (SFO) collaborate more effectively, leading to an increase in coordinated prosecutions. More jurisdictions are bringing in criminal liability for bribery and corruption breaches, and penalties for non-compliance are rising. An abundance of new legislation has come into force, from the “Sapin II” law in France to new anti-corruption laws in Argentina. In the U.S., the current administration’s foreign policy is driving massive money laundering and sanction violations cases.

Alongside this, governments face increased pressure from the public and the press to respond to regulatory breaches. Across the world, a new generation is pushing for increased transparency and demanding that governments and corporates are held to account. Growing public scrutiny puts pressure on regulators to act, and makes non-compliance almost impossible to ignore.

Stephanie Yonekura

Partner, Los Angeles

Companies keen to expand are looking to developing markets, which are traditionally less transparent and harder to operate in. While extraction industries have always operated in these markets, companies in other sectors are increasingly seeing these jurisdictions as routes to growth. Almost 90% of compliance leaders feel some kind of pressure to proceed with their growth strategy in Asia, Latin America, and Africa despite bribery and corruption concerns. This is particularly acute in the U.S., where almost a quarter (23%) of compliance leaders feel “a lot of pressure” to press ahead despite misgivings.

The repercussions for non-compliance can be severe, especially in the U.S. An ‘ability to pay’ analysis is often incorporated into the decision on the size of penalty, and it is becoming clear that this focuses on whether a company can pay and survive, rather than pay and thrive. Even when margins are tight, the compliance team is not the place to look for possible budget cuts. When it comes to AB&C compliance, awareness must lead to action.

Spotlight on Brazil

Few countries exemplify these ‘twin pressures’ better than Brazil. Recent figures have shown some economic recovery and a rebound in job creation, but the country is still struggling with long-term recession and persistently high levels of unemployment. Against this backdrop, companies feel intense pressure to grow profits, and leadership teams seek to produce results at almost any cost.

But pressure is coming from the other direction too. In January 2014, Brazil’s new anti-bribery law, often referred to as the Clean Companies Act (CCA), came into effect. Applying to both Brazilian businesses and foreign companies with any presence in Brazil, the law makes companies strictly liable for prohibited acts committed in their interest or for their benefit, regardless of the company’s intent or knowledge.

And as the mammoth Lavo Jato (Car Wash) investigation continues, the climate of fierce anti-corruption investigation and enforcement intensifies. Companies have had to step back and take this issue seriously. Despite the desire for growth, they must introduce and implement robust compliance programs, or risk facing fierce public prosecutors and the new law with its significant penalties.

Isabel Costa Carvalho

Partner, São Paulo

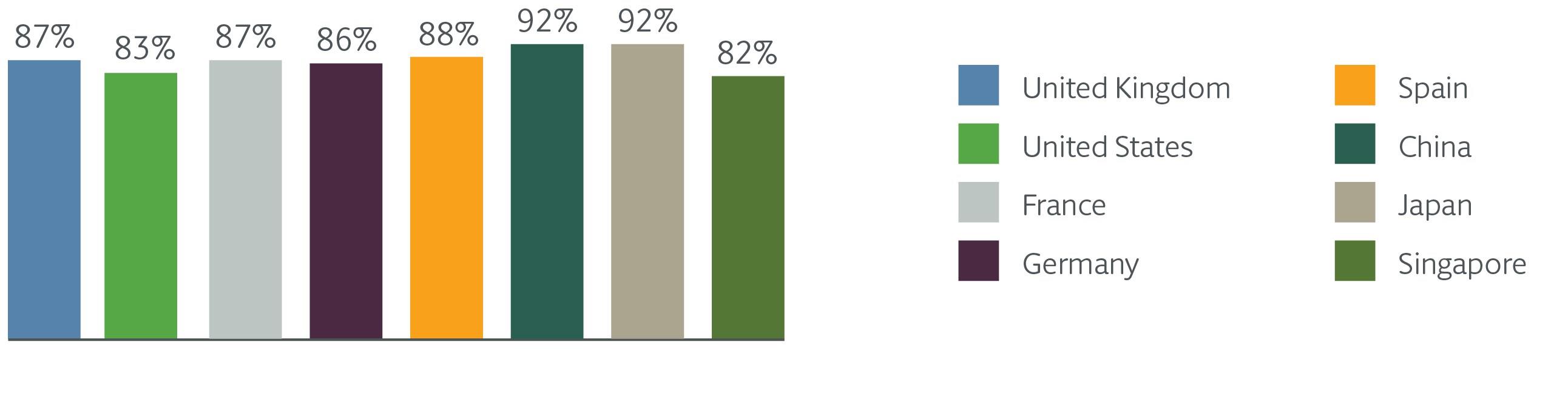

Figure 1: There is pressure within my organisation to proceed with the growth strategy in Asia, Latin America, and Africa, despite AB&C concerns

Complexity and intensity

While the compliance team may warn against entering certain jurisdictions at all, this is unlikely to be the path that the business follows, especially if the potential rewards are great. Leaders must therefore perform a delicate balancing act, proceeding with caution and putting robust compliance processes and procedures in place. However, our study reveals that many companies are failing to achieve this balancing act: 52% of compliance leaders say that many people in their business fail to follow AB&C procedures, a deeply worrying statistic that highlights the challenge of effectively implementing policies.

Compliance teams are dealing with increased complexity and intensity, as new layers of AB&C legislation are introduced. While companies could previously adopt a ‘one size fits all’ approach by adhering to the strictest legislation, different laws now require different behaviors. Complying with the U.S. Foreign Corrupt Practices Act or the UK Bribery Act does not necessarily mean compliance with France’s Sapin II legislation, for example, which requires implementation of an anti-bribery compliance program that fulfils very specific requirements. Investigations are becoming more complex too, often incorporating a wide range of breaches, like fraud, money laundering, and corruption.

Furthermore, the teams dealing with AB&C compliance are often also dealing with other aspects of compliance, such as data privacy and regulatory compliance. Expanding regulatory pressure in these areas – the EU’s onerous General Data Protection Regulation, for example – means that teams are stretched. While some leaders put in place a single, central team to handle all aspects of compliance, other corporates may have separate, specialized teams. The latter approach helps to avoid the problem of AB&C compliance being neglected when other compliance pressures are intense, but it can also pose its own coordination and communication challenges.

Ever-increasing complexity is the curse of the CCO. The job of the compliance leader is to translate complex legislative obligations into clear, easy-to-follow policies. As long as bribery policies are comprehensible and communicated well, there is no reason for employees not to comply. Often, however, corporate compliance policies are too complex in themselves and focus on black letter law: the draftsperson often doesn't think enough about what the policy actually does, and whether an employee would know where to go when facing a particular issue. A good example of this is in respect to doing due diligence on third parties: why should a front line employee know that the bribery policy is the right place to find guidance on this?

The recent trial of former employees of UK seismology company Güralp Systems shows where poor policy implementation and communication can lead. Prosecuting counsel Greg Unwin told the jury that staff members were only given a quick overview of the business’s anti-bribery policy, and the sales team saw it as “an annoyance, something finance wanted them to do.''

Policies can’t just be a box-ticking exercise. Ultimately, it’s about proper implementation within the commercial context. If a policy is properly implemented and procedures are rigorous, there is less room for things to go wrong.

Liam Naidoo

Partner, London

As leaders deal with ever-changing regulatory landscapes and fast-paced political change, they need to navigate the need for continual reinvestment in their AB&C governance practices. With more regulations, higher fines, and fiercer enforcement across the globe, CEOs and their management teams must be fully apprised of regional and local laws before pushing ahead with investment and expansion plans.

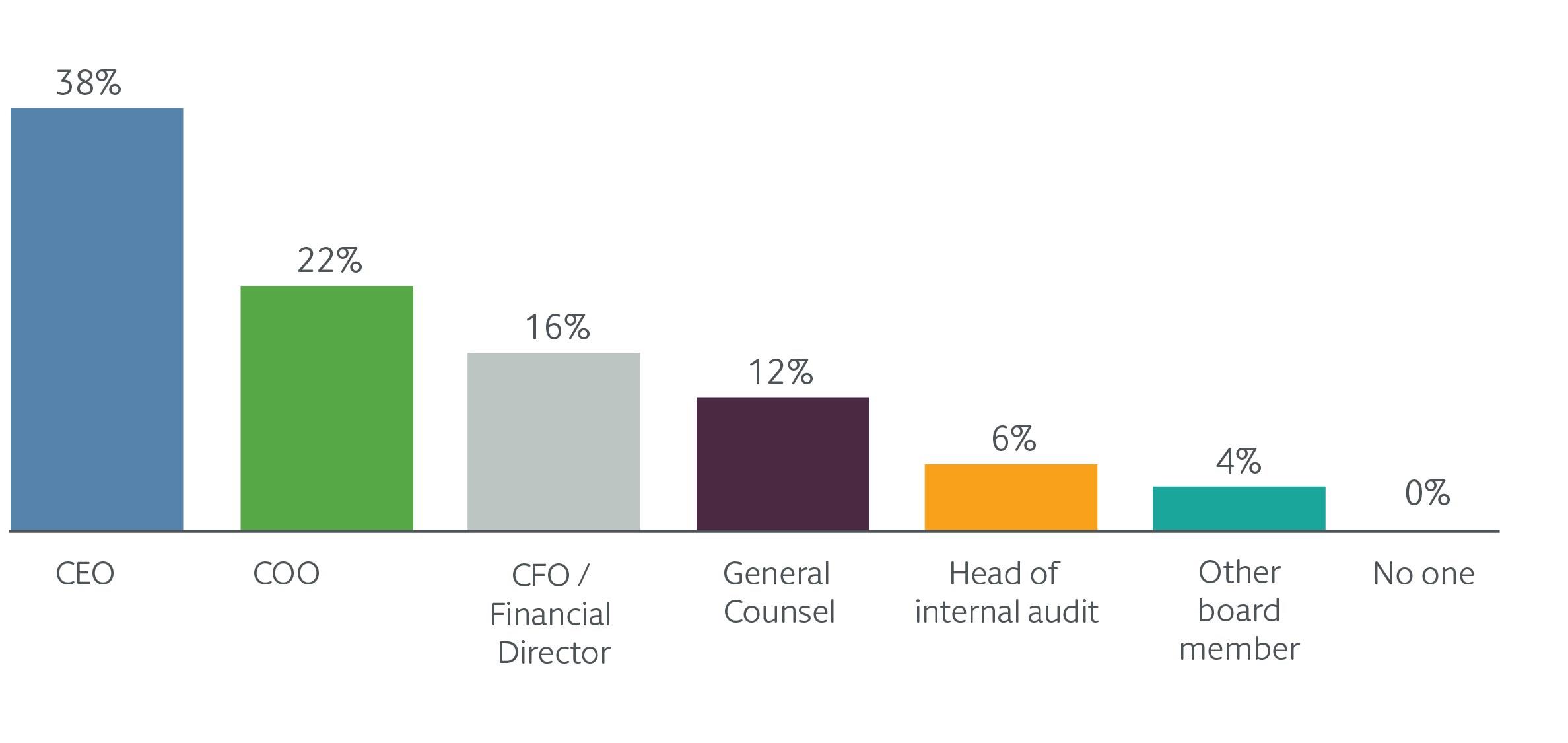

Figure 2: The structure of the compliance function

Figure 2a: Who the head of compliance reports to (2020)1

Figure 2b. The number of people working on AB&C compliance in the compliance team globally (2020)

Regulatory activity is relentless, and compliance teams cannot take on every challenge. Businesses need to be willing to have an open and powerful debate about who is going to be responsible for what. Overstretched compliance teams must remind the board what they are focusing on, and be clear about areas where other parts of the business need to assume responsibility. The cultural component cannot be underestimated either: boards and leadership teams are increasingly recognizing the crucial role that culture plays in ensuring that employees follow guidelines.

When it comes to choosing a law firm to work with, footprint matters. Firms with a broad coverage can be invaluable, as bribery and corruption challenges often arise in countries where there is limited infrastructure and scant legal resource. Businesses want to see value from their compliance programs, and choosing the right legal partner is a critical part of this.

Adam Jones

Senior VP and GC for Ethics and Compliance, Smiths Group

The compliance team freeze

CEOs have a balancing act on their hands, juggling the pressures of going for growth with increasing compliance pressures. Adding to this challenge is the squeeze on compliance teams uncovered by our research.

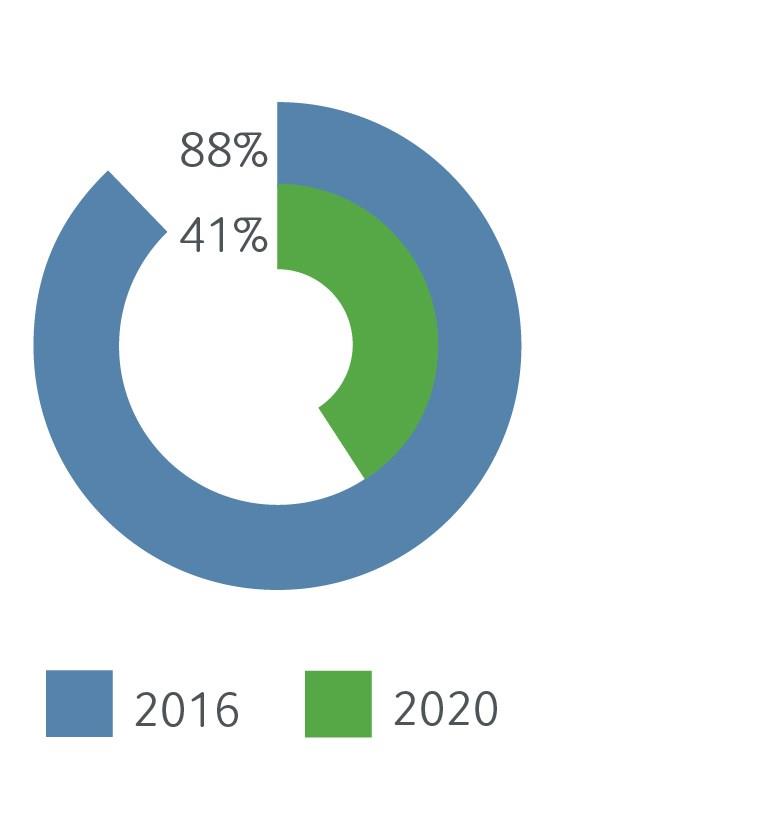

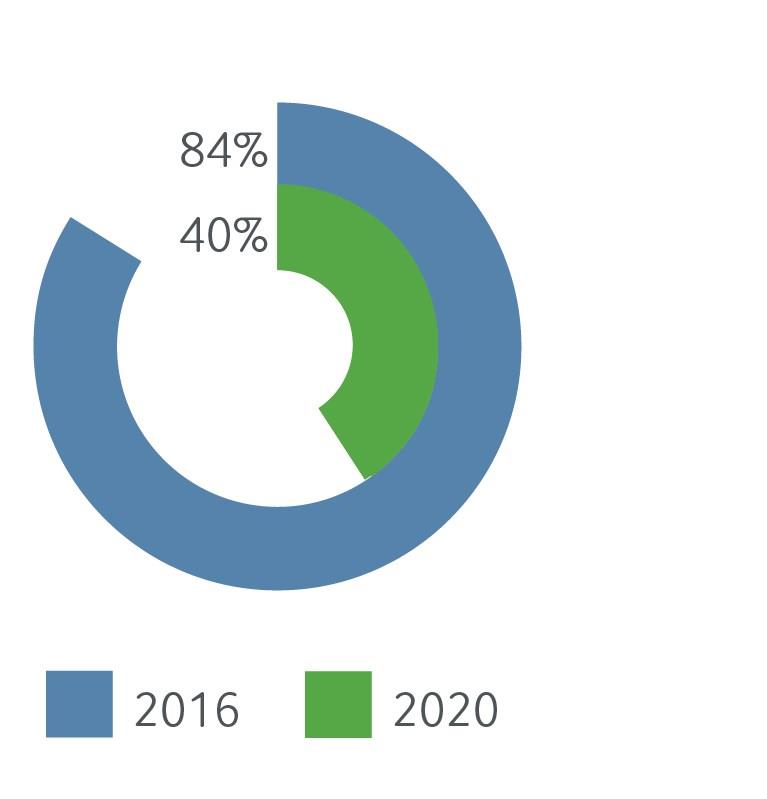

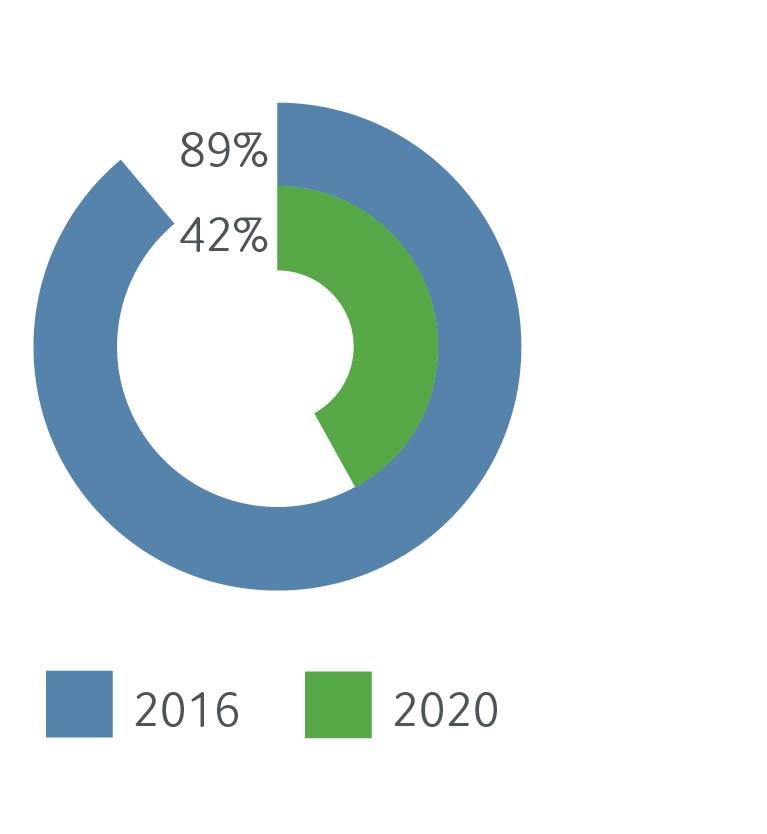

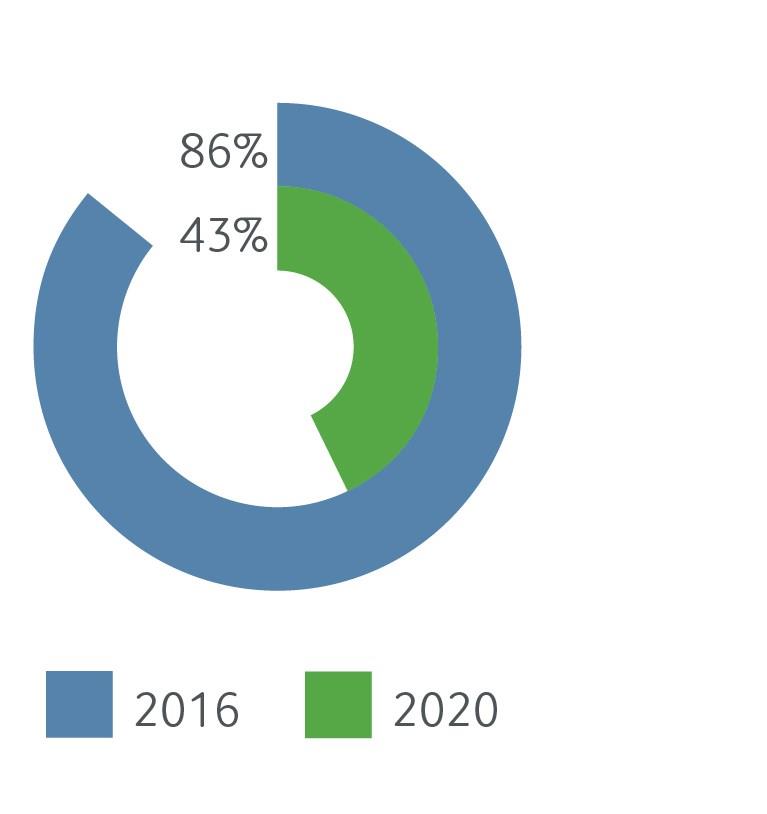

This year, only 41% of compliance leaders told us that their AB&C budget had increased over the last three years, compared to 88% in 2016. And for the majority of businesses, the next year is unlikely to bring an additional budget boost: only 40% think that their budget will increase over the next 12 months, compared to 84% who expected a budget increase back in 2016. It is a similar story in terms of team size: in 2016, 89% of compliance leaders told us their compliance team had grown over the last three years, but only 42% said the same this year, and a similar proportion (43%) expect a team increase in the next year.

There are political, economic, and technological drivers for these significant differences. In 2016, AB&C was clearly top-of-mind for many organizations, with companies keen to bolster their compliance functions. Now, many companies are preparing for a possible recession, by cutting resources or at least suspending investment. Furthermore, good compliance teams can sometimes be victims of their own success: leaders may believe that if they are not facing any major problems or investigations, the compliance team is under-occupied and can be cut. On the other hand, a company that is struggling with compliance issues despite increasing compliance team headcount may decide that they have not made a wise investment, and seek to reduce their team. There is also a perception in some companies that more sophisticated technology, including the use of data and analytics in compliance, can enable them to do ‘more with less’, expanding resources without adding full-time employees.

However, there may also be a more positive reason for the lower levels of compliance team growth and investment. Compliance is cross-functional, and is not restricted to the compliance team. Companies are perhaps instead investing in compliance expertise in other departments, including HR, procurement, and CSR. Organizations that do compliance well have embedded it fully across the company; lower levels of investment and growth in the team may indicate that compliance is actually becoming more integrated across the organization.

Spotlight on the U.S.

Running up to the 2016 presidential election, there was a steady rise in AB&C activity and budgeting for compliance programs. But then the tone of the election campaign led many to believe that Trump’s presidency would see a drop-off in enforcement activities. This may go some way to explaining the lower levels of investment in AB&C compliance teams compared to four years ago.

The DoJ under Trump has indicated that as long as companies come forward and cooperate, a resolution may be possible, allowing the business to continue operating. They are conveying the message that fines may be big, but they won’t be crippling, and presenting a more business-friendly image than previous administrations. A large number of memos on policy issues have recently been published, trying to ensure that people understand the rules and can explain them clearly to their clients.

However, it’s important for organizations to understand that although the conversation and messaging around compliance may have shifted somewhat, aggressive enforcement efforts are still underway, and large fines are still being issued.

Lillian S. Hardy

Partner, Washington D.C.

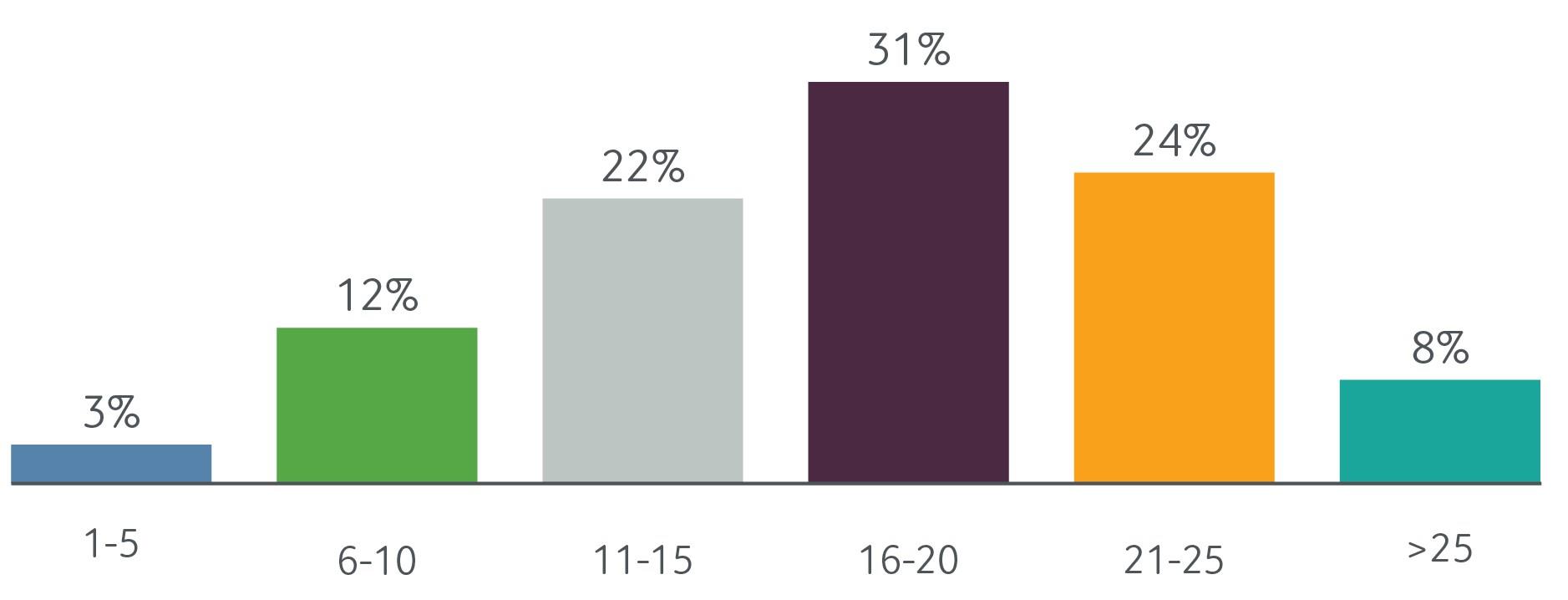

Figure 3: The compliance team freeze: team size and budget changes, 2016 vs. 2020

Figure 3a. The proportion of organizations that increased overall AB&C budget over the last three years

Figure 3b. The proportion of organizations that will increase overall AB&C budget over the next year

Figure 3c. The proportion of organizations that have increased the size of their compliance team over the last three years

Figure 3d. The proportion of organizations that will increase the size of their compliance team over the next year

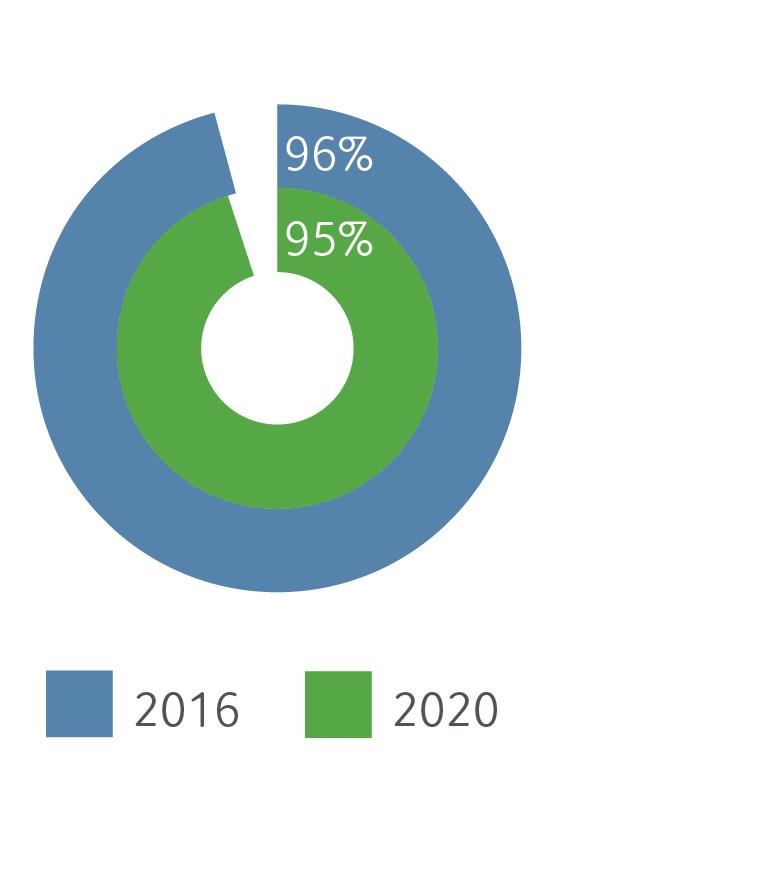

But, despite this squeeze on compliance teams, it seems that standards have not slipped:

Figure 3e. In 2016 and 2020, the vast majority of compliance leaders say that their teams are meeting or exceeding expectations

The data seems to show a two-tier system emerging, however; while the majority of businesses are not growing their compliance teams or budgets, those that are investing are doing so by a more substantial amount. The companies that are increasing their compliance budget over the next year are doing so by an average of 19% (compared to 13% in 2016), and team size is increasing by an average of 21% (compared to 12% in 2016).

This indicates a widening gap between the companies that are focused on ramping up their compliance efforts and those with static teams and budgets, struggling to deal with increasing regulatory pressures without a corresponding increase in resources.

1 All figures have been rounded to the nearest whole number, as a result their sum does not equal 100%.