TMT: more resources, but a risk-taking approach

Tech, media, and telecom (TMT) companies acknowledge the importance of robust AB&C compliance teams and programs, but are struggling to balance this with a desire to grow quickly and make inroads in new markets.

Of all the sectors studied, TMT companies are best structured for success. Almost 40% have large AB&C teams (more than 20 people working globally), compared to an average of 32% across all sectors surveyed. And in almost half (49%) of TMT companies, the head of AB&C compliance reports directly to the CEO, compared to an average of 38% across all sectors. The compliance leader in these companies is also most likely to attend board meetings regularly: 31% attend more than twice a year, the highest of any sector in the study.

Despite this, however, there is evidence that these companies are treading a dangerous path when it comes to bribery and corruption. A substantial number of compliance leaders in this sector agree that their organization has made risky investments in Asia, Latin America, and Africa in order to meet growth targets (59%, compared to an average of 53% across all sectors). More than half of compliance leaders in this sector (55%) say that their organization just pays lip service to AB&C concerns in these regions, taking them seriously only if there’s a chance of getting caught.

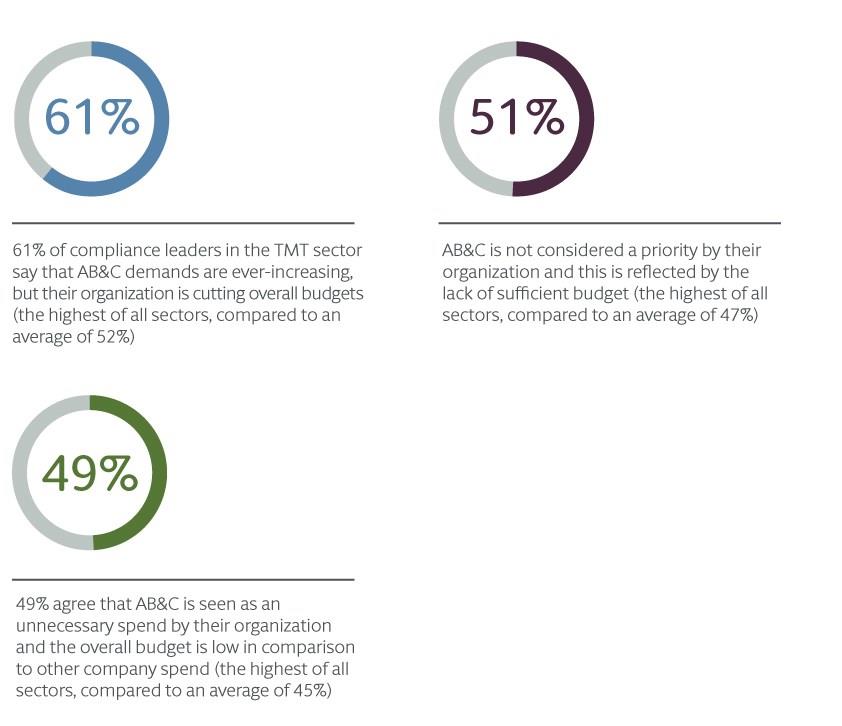

Figure 5: Compliance leaders in the TMT sector are more likely to be dealing with budget cuts and a lack of focus on compliance than compliance leaders in any other sector

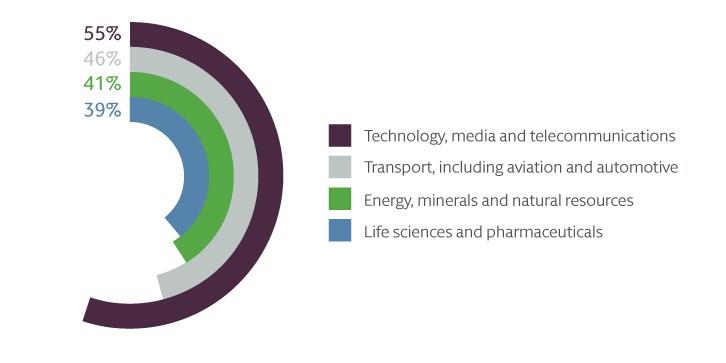

Figure 6: “My organization only pays lip service to AB&C concerns in Asia, Latin America, and Africa; it only takes them seriously if there’s a chance of getting caught”

Compared to other sectors, TMT companies tend to have huge, disparate networks of users, and a global reach from the outset. Their work is inherently complex, and they are exposed to compliance legislation from multiple jurisdictions. Tech companies are also innovative by their very nature, and need to push boundaries to survive.

TMT companies need to keep on top of the rapidly evolving risk picture, and ensure that they have the right systems and processes in place. Companies would be wise to follow the example of an industry like life sciences, which has been dealing with intense regulatory pressure for a long time.

If TMT companies begin to integrate AB&C compliance into the way they do business, embedding it effectively throughout their organization, they may be able to handle compliance in a more agile fashion, with leaner teams but better results.

Maurice Burke

Partner, Singapore

Life sciences: test, evaluate, update, repeat

Life sciences and pharmaceuticals companies have been dealing with intense regulatory pressure for decades, and as a result they tend to have a mature, comprehensive, and integrated approach to compliance. Our study shows that businesses in this sector have the fewest AB&C professionals, but they are the most diligent in terms of testing programs, updating procedures, and delivering training.

Only 22% of life sciences businesses operate with large teams (more than 20 people), compared to an average of 32% across all sectors, but these companies are testing and updating procedures more regularly. Almost a quarter (23%) of compliance leaders say they test the effectiveness of their AB&C programs more than twice a year, compared to an average of 19% across all sectors, and a quarter update AB&C procedures more than twice a year, compared to an average of 19% across all sectors.

This indicates that compliance is embedded throughout the business, with dedicated compliance professionals supported by other functions such as marketing and finance. In this high-risk sector, compliance and regulation is deeply ingrained in company culture, and general awareness across all lines of business tends to be high.

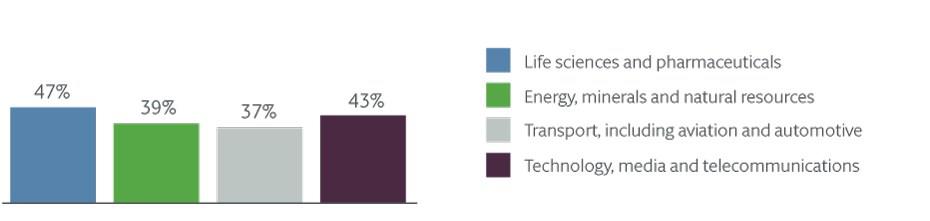

Figure 7: Companies in the life sciences and pharmaceuticals sector update and test their programs and procedures most regularly.

Transport and energy: lagging behind

Despite the relatively high levels of bribery and corruption risk that transport and energy companies face, our study shows that these companies are not taking a proactive approach to compliance. Compared to the other sectors in our study, these sectors seem reluctant to invest in their AB&C teams, and have low rates of testing and evaluation.

Figure 8: Sector comparisons: transport and energy companies seem to have a less proactive approach to AB&C compliance.

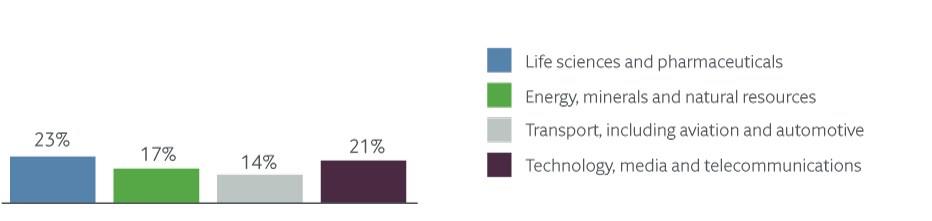

Figure 8a: Organizations that have increased overall AB&C budget over the last three years - by sector

Figure 8b. Compliance leaders who expect their team to increase over the next year - by sector

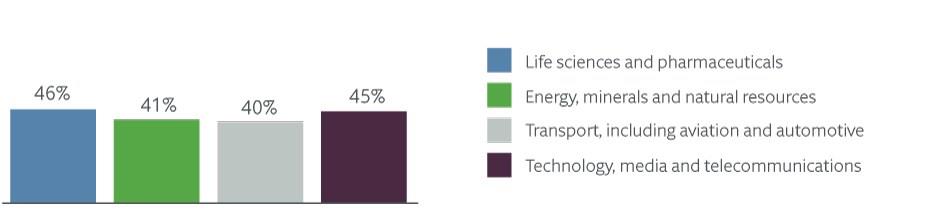

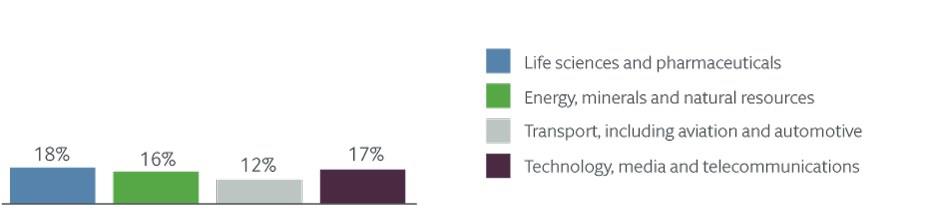

Figure 8c. Companies that test the effectiveness of their own AB&C programs more than twice a year - by sector

Figure 8d. Companies that get an external evaluation of their AB&C program more than twice a year - by sector

These relatively low levels of investment and testing are surprising in these industries, which are inherently multinational and exposed to several layers of risk. Both transport and energy companies are project-based, and most companies in these sectors operate in the developing world, with a lot of interaction with government bodies and third parties, and industry practices that often give rise to bribery risks. A robust approach to compliance – including thorough due diligence and monitoring of third parties – is therefore particularly critical. As enforcement becomes more coordinated across the world, these companies will need to seek support from advisers that are global in nature and can truly advise on all of the risk and compliance issues that they face.